Canada's Indigenous communities are quietly revolutionising the energy sector, becoming major players in infrastructure investments worth over $6 billion while creating a unique model for ESG-driven partnerships that's catching global attention. Indigenous entities now partner in or own nearly 20% of Canada's electricity-generating infrastructure, with almost all of it renewable energy, representing a fundamental shift from traditional consultation models to true economic partnership.

The numbers tell a compelling story: 38 major projects announced between 2022-2024 valued from C$13 million to C$14.5 billion, federal commitments exceeding $14 billion since 2016, and Indigenous communities acquiring billion-dollar stakes in critical infrastructure like pipelines and transmission systems. This isn't just about reconciliation—it's about smart business that delivers genuine ESG outcomes while tapping into one of North America's most underutilised investment ecosystems.

Government backing creates unprecedented opportunities

The Canadian government has fundamentally restructured how it approaches Indigenous infrastructure partnerships, moving beyond grants to sophisticated loan guarantee programmes that enable large-scale equity ownership. Budget 2024 introduced a $5 billion Indigenous Loan Guarantee Programme, offering sector-agnostic support for natural resource and energy projects where Indigenous communities can secure commercial financing with government backing.

Alberta leads this transformation through its Indigenous Opportunities Corporation (AIOC), which has facilitated $3 billion in loan guarantees supporting 43 First Nations and Métis groups across eight major projects. The results speak for themselves: 23 Indigenous communities recently acquired an 11.57% stake in seven Enbridge pipelines worth $1.12 billion, creating the largest energy-related Indigenous economic partnership in North America.

The Canada Infrastructure Bank's Indigenous Equity Initiative offers $5-100 million investments covering up to 90% of Indigenous equity requirements, while the Wah-ila-toos programme provides single-window access to clean energy funding across federal departments. This coordinated approach contrasts sharply with the fragmented multi-agency system in the United States, where tribes must navigate complex relationships between the Department of Energy, Bureau of Indian Affairs, Treasury, and FERC.

ESG integration drives investment appeal

Indigenous partnerships deliver measurable ESG outcomes that increasingly matter to institutional investors. Environmental benefits include 6.6 million tonnes of GHG emissions reduction over 40 years from projects like Wataynikaneyap Power's transmission system, which eliminated diesel dependency for 17 First Nations communities while saving $1.3 billion over the project lifecycle.

The social impact extends beyond energy access. Fort McKay First Nation's $350 million investment in Suncor's East Tank Farm Development created a community with zero unemployment and average annual incomes of $120,000, while funding health centres, housing, and cultural programmes. Traditional knowledge integration enhances environmental monitoring and sustainable development practices, creating governance models that respect Indigenous decision-making protocols while meeting modern regulatory requirements.

Corporate Canada is taking notice. Partnership Accreditation in Indigenous Relations (PAIR) certification—held by only 40 Canadian businesses—is becoming essential for major projects, while companies like Hydro One now commit to offering 50% stakes to First Nations in all future large transmission projects. The regulatory environment increasingly requires Indigenous participation not just for social license but for project approval itself.

Clean energy dominance defines the landscape

Indigenous communities are strategically focusing on renewable energy, with wind power representing 40% of new Indigenous equity investments in 2023-2025, followed by solar at 18%. The Cedar LNG project exemplifies this approach—the world's first Indigenous majority-owned LNG facility (50.1% Haisla Nation ownership) targets near-zero emissions by 2030 while being powered entirely by clean BC Hydro electricity.

This clean energy focus creates competitive advantages in markets increasingly dominated by ESG considerations. British Columbia's 2024 Call for Power required 25% First Nations equity ownership, while federal procurement increasingly favours Indigenous-partnered projects. Indigenous communities control lands with significant renewable energy potential—tribal lands in North America contain 17,600 billion kWh/year solar potential and 535 billion kWh/year wind potential.

How Canada outpaces the US approach

While the United States offers substantial funding through the $14 billion Inflation Reduction Act allocation for tribes, Canada's approach proves more streamlined and effective. The US system requires tribes to navigate multiple federal agencies with complex tax credit systems, while only one utility-scale wind farm currently operates on tribal lands, despite tribes hosting 8% of US wind potential.

Canada's coordinated single-window approach through programmes like Wah-ila-toos, combined with provincial loan guarantee programmes, creates clearer pathways to project development. The Canadian emphasis on UNDRIP implementation and Free, Prior, and Informed Consent provides stronger legal frameworks, while provincial coordination offers additional implementation support absent in the US federal system.

The regulatory efficiency shows in results: Canada has 194 active renewable energy projects associated with Indigenous communities, while the US struggles with grid interconnection barriers and complex multi-agency coordination despite higher total funding availability.

Partnership models evolve toward Indigenous control

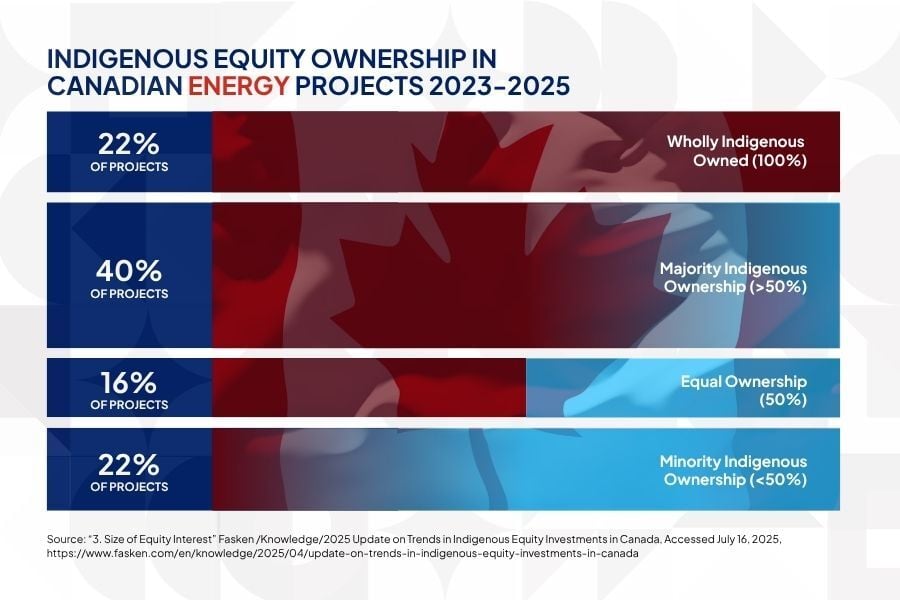

The trend is unmistakably toward Indigenous majority ownership—76% of new projects in 2023-2025 are owned by single Indigenous communities, with 40% representing majority ownership and 22% wholly Indigenous-owned. The Wataynikaneyap Power project demonstrates this evolution: 24 First Nations hold 51% ownership of the $1.9 billion transmission system, creating the largest First Nations-led infrastructure project in Canadian history.

Revenue-sharing models are replacing traditional consultation payments, creating long-term value streams aligned with Indigenous seven-generations thinking. Multi-community partnerships are emerging for larger projects, with collective structures enabling Indigenous communities to pool resources and expertise for billion-dollar investments.

Challenges remain, but solutions emerge

Access to capital remains the primary barrier, though government loan guarantee programmes are addressing this systematically. Technical capacity building continues through federal programmes that have trained over 600 individuals in energy sector skills, while Indigenous Development Corporations—294 operating across Canada—provide institutional frameworks for managing large-scale investments.

The infrastructure gap remains substantial, with the Assembly of First Nations estimating $349 billion needed by 2030. However, the trajectory suggests Indigenous communities are positioning themselves not just as beneficiaries but as leaders in Canada's infrastructure development and clean energy transition.

The business case for partnership

For investors, Indigenous partnerships offer reduced project risk, enhanced social license, improved ESG credentials, and access to resource-rich territories essential for development. The emergence of sophisticated Indigenous financial structures and professional capacity to manage large-scale investments creates attractive co-investment opportunities with government backing.

Canada's Indigenous energy partnerships represent more than reconciliation—they're creating a new model for sustainable development that integrates traditional knowledge with modern technology, community values with commercial viability, and environmental stewardship with economic opportunity. As global investors increasingly prioritise ESG outcomes, these partnerships offer a compelling blueprint for responsible resource development that delivers shared prosperity while advancing climate goals.

The momentum is clear: Indigenous communities are becoming major infrastructure owners and operators, supported by government policy and driven by market forces that increasingly reward authentic ESG integration. For business leaders seeking investment opportunities that align profit with purpose, Canada's Indigenous energy partnerships offer unprecedented access to a rapidly expanding market built on principles of shared success and sustainable development.