Canada has made over $700 million in investments under the Canadian Critical Minerals Strategy1 and catalysed a 15% increase in the production of key critical minerals – just 5% away from the target of 20% by 2030. This remarkable progress reflects a fundamental shift in how Canada approaches resource development, with Indigenous communities positioned as leaders rather than stakeholders in the nation's most strategic economic opportunity.

The convergence of geopolitical necessity, technological demand, and Indigenous sovereignty creates unprecedented investment conditions for UK and continental European investors seeking authentic partnerships in Canadian critical minerals development.

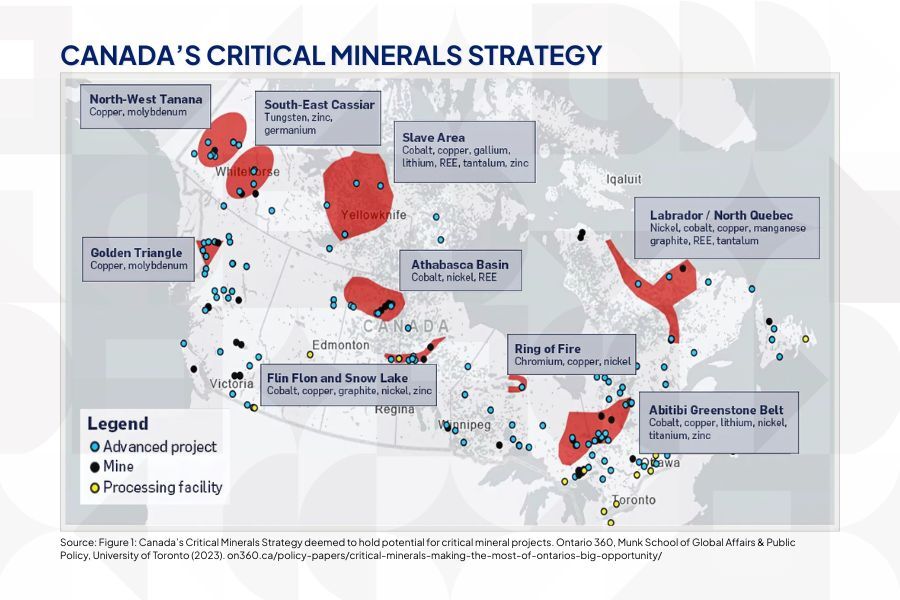

The Geographic and Political Reality

Canada's 31 priority critical minerals are predominantly located in Indigenous territories, with Aboriginal and treaty rights protected through early, meaningful, and ongoing engagement with Indigenous peoples, from project conception to development and oversight. This is geology meeting constitutional reality. The Canadian Shield, where most critical mineral deposits are found, overlaps significantly with Indigenous traditional territories protected under Section 35 of the Constitution Act 2.

Ontario alone is making a nearly $3.1 billion investment in critical minerals development, with Indigenous partnerships at the forefront of the province's resource development strategy. This represents the largest provincial commitment to Indigenous-led resource development in Canadian history.

Federal Investment Framework Creates Competitive Advantage

The Government of Canada announced additional measures, including a two-year extension of the 15-percent Mineral Exploration Tax Credit (METC) until March 31, 2027, expected to provide $110 million to support exploration investment across Canada, particularly in Indigenous northern and remote communities.

Current Tax Incentive Structure:

- 30% Critical Mineral Exploration Tax Credit (CMETC) for specified mineral exploration expenses targeting 15 eligible critical minerals

- 15% Mineral Exploration Tax Credit extended until March 31, 2027

- 30% Clean Technology Manufacturing Investment Tax Credit for extraction, processing, and recycling of lithium, cobalt, nickel, graphite, copper and rare earth elements

Ring of Fire: Infrastructure Investment Accelerates

Ontario is spending nearly $62 million to improve access to the Ring of Fire, with construction beginning in spring 2025 on the Geraldton road project that will serve as the gateway to the mineral-rich region. This infrastructure investment represents the first tangible progress toward unlocking what mining analysts describe as "world-class" deposits.

Ring of Fire Development Status:

- Fifteen First Nation partners and the Impact Assessment Agency of Canada have finalised the terms of reference for the Regional Assessment in the Ring of Fire Area in January 2025

- 26,167 active mining claims held by 15 companies covering approximately 4,972 square kilometres as of January 2022

- Aroland First Nation signed a deal worth more than $20 million for community infrastructure projects related to mineral development in January 2025

Federal Strategy Evolution and Investment Scale

The Critical Minerals Infrastructure Fund3 (CMIF) launched a second call for proposals with up to $500 million in funding available for energy and transportation infrastructure projects. Additional programmes demonstrate unprecedented government commitment:

- $80 million Indigenous Natural Resources Partnerships programme for projects increasing Indigenous community capacity and collaboration

- $10 million Critical Minerals Geoscience and Data initiative for provinces and territories

- $43.5 million announced for Quebec critical minerals projects in February 2025

International Partnerships Drive Market Access

Canada now has critical minerals-focused collaboration mechanisms with the United States (2020), the United Kingdom (2023), the European Union (2021), France (2023), Germany (2023), Japan (2023), Australia (2024), Chile (2023) and South Korea (2023). These bilateral agreements create preferential access to allied markets whilst diversifying supply chains away from non-aligned countries.

Canada holds the G7 Presidency in 20254 , positioning the nation to drive collective action on critical minerals to support the global transition to green energy and more resilient supply chains.

Investment Structure Innovation and Risk Mitigation

Recent project financing demonstrates sophisticated approaches to Indigenous partnership development:

Blended Finance Models:

- Development finance institution participation providing patient capital

- Government guarantees enhancing credit profiles for private investment

- Revenue-sharing agreements with commodity-linked payments

Technology Integration Benefits:

- Traditional ecological knowledge improving environmental performance

- Community-controlled research and development capabilities

- Intellectual property development creating additional revenue streams

ESG Leadership Creates Competitive Moats

The Canadian Critical Minerals Strategy includes advancing reconciliation with Indigenous peoples and promoting climate action and environmental protection as core objectives. However, Natural Resources Canada did not have strong enough governance or robust risk analysis to assess environmental and climate impacts adequately. This creates opportunities for private investors to lead where government oversight remains developing.

Indigenous partnerships provide superior ESG credentials through:

- Constitutional protection of Indigenous rights providing legal certainty

- Traditional stewardship practices exceeding regulatory environmental standards

- Community ownership creating aligned incentives for responsible development

- UNDRIP compliance ensuring international social licence sustainability

Market Access and Processing Advantages

Canada produces over 60 minerals and metals5, including 22 of the 50 minerals listed as critical by the U.S. Geological Survey, and ranks among the top countries globally for sustainable mining thanks to unique environmental, social and governance advantages.

Processing Development Focus:

- Indigenous communities increasingly targeting value-added processing over raw extraction

- Processing facilities creating 5-10x more employment than extraction alone

- Technology transfer building long-term community technical capacity

- Control over supply chain chokepoints enhancing negotiating leverage

Investment Implications for UK and European Institutions

Current market conditions create exceptional opportunities for institutional investors:

Early-Stage Positioning Advantages:

- Partner with Indigenous communities during project development phase rather than production

- Provide patient infrastructure capital ahead of major mining investment

- Secure long-term supply agreements with Indigenous-owned processing facilities

Portfolio Construction Recommendations:

- Diversify across multiple critical minerals and geographic regions within Canada

- Balance extraction, processing, and infrastructure investment exposure

- Include both direct equity and revenue-sharing structures for optimal risk-adjusted returns

Regulatory Navigation Benefits:

- Indigenous partnerships provide constitutional protection unavailable through other structures

- Federal and provincial government support programmes enhance project viability

- International recognition of Indigenous sovereignty reduces political risk

Policy Momentum and Future Outlook

Ontario plans to triple the Indigenous Participation Fund loan guarantees to $3 billion6and broaden scope to include mining, critical minerals, energy and pipelines, helping Indigenous communities gain equity stakes in major resource developments. This represents a fundamental shift toward Indigenous ownership rather than mere participation in resource development.

The province is also providing $10 million over three years to create scholarships for First Nations postsecondary students pursuing careers in resource development, building long-term Indigenous leadership in the sector.

Regulatory Environment Evolution:

- Bill 5 controversies: Ontario's legislation creating "special economic zones" exempt from environmental rules faces constitutional challenges from nine First Nations, creating both opportunities and risks for investors

- Environmental assessments: Ring of Fire regional assessment with 15 First Nation partners demonstrates evolution toward co-led regulatory processes

- UNDRIP implementation: Federal commitment to United Nations Declaration on the Rights of Indigenous Peoples creates stronger Indigenous consent requirements

Market Timing and Competitive Positioning

The confluence of geopolitical necessity following U.S. trade tensions, technological demand growth, and Indigenous constitutional authority creates generational investment opportunities. UK and continental European institutions positioned ahead of this transformation will secure preferential access to North America's most strategically positioned resource development whilst advancing reconciliation and environmental leadership.

Canada's whole-of-government approach to critical mineral development is collaborative, forward-looking, and adaptive, providing policy stability for long-term investment commitments. The mining sector's position as the second-largest private sector employer of Indigenous Peoples demonstrates established economic relationships ready for expansion.

Strategic Timing Advantages:

- Early partnership positioning: Engaging before mainstream institutional recognition provides better terms and stronger community relationships

- Infrastructure development phase: Current infrastructure investment phase offers optimal entry timing ahead of production

- Policy support alignment: Federal and provincial policy support at historic high levels provides optimal regulatory environment

Bottom Line for Institutional Investors

Traditional mining consultation models have evolved into Indigenous-led ownership structures with constitutional protection, federal tax incentives reaching 30%, and processing capabilities creating multiple revenue streams beyond extraction. This transformation creates investment opportunities combining financial returns with reconciliation advancement and supply chain security.

For UK and European institutions, the strategic imperative centres on securing early-stage partnerships before this Indigenous-led transformation becomes widely recognised amongst global institutional investors.

1 https://www.canada.ca/en/natural-resources-canada/news/2025/03/investing-to-make-canada-a-global-critical-minerals-superpower0.html ↩ Back

2 https://www.rcaanc-cirnac.gc.ca/eng/1100100014413/1535468629182 ↩ Back

3 https://www.canada.ca/en/campaign/critical-minerals-in-canada/federal-support-for-critical-mineral-projects-and-value-chains/critical-minerals-infrastructure-fund1.html↩ Back

4 https://g7.canada.ca/en/#:~:text=Canada's%202025%20G7%20Presidency,View%20all%20news↩ Back

5 https://natural-resources.canada.ca/minerals-mining/mining-data-statistics-analysis/minerals-metals-facts↩ Back

6 https://news.ontario.ca/en/release/1005924/province-investing-31-billion-to-support-indigenous-partnership-in-critical-mineral-development↩ Back