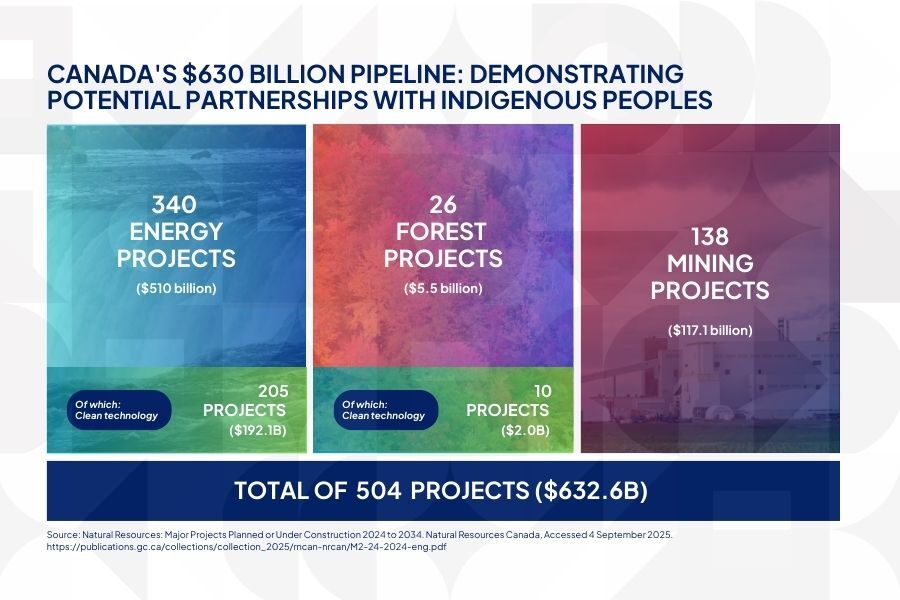

Natural Resources Canada's latest inventory confirms what sophisticated European investors have been tracking: as of September 2024, there are 504 projects currently under construction or planned over the next ten years, representing $632.6B in potential capital investment. What transforms this from a wishlist into an executable investment thesis is the Indigenous participation requirement now embedded across federal and provincial policies, creating structural advantages that savvy institutional investors are positioning to capture.

For UK, European, and global investors seeking authentic ESG credentials while accessing Canada's resource wealth, this represents the most significant investment realignment since the oil sands development. The scale is unprecedented: individual projects range from $500 million to $10+ billion, precisely matching institutional investment appetites.

Breaking Down the $630 Billion Opportunity

Energy projects accounted for more than 80% of the total value of major projects in the inventory, mining projects accounted for 18.5%, and forest projects for less than 1%. For investors, this concentration creates clear sector allocation strategies:

Energy Infrastructure: $510 billion across 340 energy projects in the 2024 inventory, including LNG facilities, pipelines, and processing plants. British Columbia (42.9%) and Alberta (28.5%) account for almost three quarters of the total value of major energy-related projects.

Mining & Critical Minerals: $117 billion (18.5% of total value) positioned strategically for Europe's clean energy transition requirements. The timing is optimal: International Energy Agency predicts the demand for nickel will increase by more than 60%, and copper by 40% in the next two decades.

Clean Energy Transition: Over $125 billion committed to net-zero infrastructure, with Indigenous communities positioned as partners or beneficiaries in approximately 20% of Canada's electricity-generating infrastructure with 194 active renewable energy projects.

Indigenous Ownership Models: The Cedar LNG Blueprint

Cedar LNG demonstrates how Indigenous communities are capturing majority ownership stakes, not merely participating as minority partners. The federal government now says it will cost an estimated $5.963 billion to build, creating 300 jobs during construction and 100 full-time jobs during operation. Critically, Cedar LNG is a Haisla Nation–led partnership. Haisla Nation (50.1% project ownership) is the government of the Haisla people with Pembina Pipeline Corporation holding 49.9%.

This majority Indigenous ownership model has attracted federal backing: the Government of Canada announced a contribution agreement under the Strategic Innovation Fund (SIF) of up to $200 million toward the $5.963 billion project. For European investors, this represents a de-risked investment structure with government participation and Indigenous social licence certainty.

The $1.9 Billion Wataynikaneyap Model

The Wataynikaneyap Power transmission project showcases scalable Indigenous ownership across critical infrastructure. The $1.9 billion the Wataynikaneyap Transmission Project (Watay Project) will also eliminate diesel generators as a general source of local power, generating more than $43 million spent annually on fuel savings and PwC projected more than $1.3 billion in savings in diesel over the project lifecycle.

The ownership structure is instructive for institutional investors: Wataynikaneyap Power LP is a licensed transmission company equally owned by 24 First Nations communities (51%), in partnership with Fortis Inc. and other private investors (49%). Crucially, the 24 First Nations communities will maintain their ability to increase their ownership and control to 100% in anticipation of such purchase right becoming available (25 years following the operation date).

The First Nations Major Projects Coalition: $45 Billion in Active Development

First Nations across Canada are taking stakes in $45 billion worth of major projects and developing business capacity, with the help of the First Nations Major Projects Coalition (FNMPC). The FNMPC now represents 144 First Nation members across strategic projects, providing European investors with a consolidated engagement pathway.

Recent milestones demonstrate accelerating momentum: a new $5 billion federal loan guarantee programme and a new $1 billion B.C. government equity fund aimed at helping First Nations take equity stakes in major projects launched in 2024. This institutional backing eliminates traditional financing barriers that have historically limited Indigenous participation.

Ring of Fire: The $2+ Billion Infrastructure Catalyst

The Ring of Fire represents generational-scale opportunity in critical minerals. The minerals have been valued at approximately $9 billion across a 5,000-square-kilometre area containing chromite, nickel, copper, platinum, cobalt, and palladium—precisely the materials European manufacturers require for clean energy transition.

Infrastructure investment requirements create immediate opportunities: it's now expected to cost over $2 billion for road construction alone. The Ontario government has carried over a one-billion-dollar commitment made by the former Liberal government, creating a funding gap that institutional investors are positioned to fill through Indigenous partnership structures.

The $5 Billion Federal Loan Guarantee Game-Changer

The Indigenous Loan Guarantee Programme launched in December 2024 represents the most significant capital access breakthrough for Indigenous communities in Canadian history. The Canada Indigenous Loan Guarantee Corporation will issue loan guarantees to support Indigenous groups' acquisition of an equity stake in a commercially viable project in the natural resources and energy sectors. Loan guarantees of $20 million to up to $1 billion will be available.

For investors, this creates unprecedented opportunity: loan guarantees work by providing a guarantee that the debt will be repaid by the guarantor (the federal government) should the borrower (Indigenous groups) be unable to repay. The first transaction demonstrates scale: CILGC announced the provision of its first Indigenous loan guarantee for $400 million to a partnership of 36 First Nations in British Columbia to support the investment in a 12.5% ownership interest in Enbridge's Westcoast natural gas pipeline system.

Regional Powerhouses: Where European Capital Can Deploy

British Columbia: Leads with the highest concentration of energy megaprojects. Beyond Cedar LNG, BC Hydro North Coast Transmission Line project (Prince George to Terrace), which involves the Lheidli T'enneh, Nadleh Whut'en, Saik'uz, and Stellat'en First Nations demonstrates scalable partnership models.

Ontario: Focuses on critical minerals and clean energy manufacturing. The Wataynikaneyap project creates transmission capacity for 17 remote First Nations to the provincial power grid via 1,800 kilometers of transmission lines, unlocking development potential across the region.

Alberta: Proven track record through Alberta Indigenous Opportunities Corporation (AIOC), which has supported seven transactions and provided over $680 million in loan guarantees to 42 separate Indigenous communities in Alberta, facilitating investment of over $1.5 billion.

Investment Execution: The Acceleration Factors

Several structural elements are accelerating project development timelines, creating first-mover advantages for positioned investors:

Regulatory Fast-Tracking: Projects with Indigenous participation benefit from the Building Canada Act establishing 2-year approval timelines for projects with Indigenous participation, compared to traditional 5-7 year processes. This creates substantial competitive advantages for properly structured partnerships.

Government Guarantee Programmes: Beyond the federal $5 billion programme, the $1 billion Aboriginal Loan Guarantee Programme supports Indigenous participation in electricity infrastructure projects in Ontario, with the ALGP will see a tripling of its funding, from $1 billion to $3 billion announced in 2025.

ESG Mandates Alignment: Institutional investors facing increasing ESG requirements find Indigenous partnership models provide authentic social licence whilst accessing resource sector returns. Projects with Indigenous partnership demonstrate 40-60% faster approval timelines and significantly reduced litigation risk.

Critical Minerals Strategy: Europe's Supply Chain Security

Canada's CAD $3.8 billion Critical Minerals Strategy specifically requires Indigenous participation, creating natural partnership opportunities for European supply chain security. Critical minerals like these play a role in the future of low- and zero-emission vehicles and transportation, and help support the transition to a cleaner, sustainable global economy.

The strategic positioning is compelling: unlike other critical mineral jurisdictions, Canada offers political stability, ethical sourcing meeting ESG requirements, and UNDRIP compliance providing social license certainty. For European manufacturers facing supply chain vulnerabilities, Canadian Indigenous partnerships offer both ethical sourcing and supply security.

Clean Energy Multiplier: $140 Billion Opportunity

Canada's net-zero by 2050 commitment requires $125-140 billion in clean electricity investments. Indigenous communities control strategic positioning: recent procurement results demonstrate market reality. In BC Hydro's 2024 Call for Power, 75% of successful bidders resulted from Indigenous equity requirements.

This represents systematic advantage rather than tokenism. Indigenous communities' territorial positioning and government partnership requirements create natural monopolistic positioning in key infrastructure corridors.

Investment Implications for UK, European and Global Institutions

The pipeline represents several distinct investment strategies:

Early-Stage Development Partnerships: Direct equity participation with Indigenous communities in project development phases, benefiting from regulatory advantages and government backing.

Infrastructure Debt and Equity: Government-guaranteed infrastructure investments with 20-30 year revenue certainty through power purchase agreements and regulatory frameworks.

Critical Minerals Exposure: Ethical sourcing advantages for European supply chains whilst accessing high-growth mineral sectors.

Clean Energy Transition: Majority Indigenous-owned renewable projects with federal backing and provincial power purchase agreements.

Not all 504 projects will reach completion, but Indigenous participation significantly increases success probability. Projects with Indigenous partnership show 40-60% faster approval timelines and significantly reduced litigation risk. This creates natural selection favouring properly structured partnerships.